In many Kenyan homes, the kitchen is more than a cooking space it serves as a social hub, storage area, and value booster for rentals or owner-occupied units. For small houses like 2-bedroom units or bedsitters, a smart kitchen layout can significantly improve functionality without exceeding your budget. This guide explores affordable kitchen layouts, clever storage solutions, and cost-effective...

Finance

Building a 2-bedroom house is a popular goal for many Kenyans, especially in growing satellite towns like Kitengela, Joska, or Ruiru. However, many first-time builders are surprised by how quickly costs can rise especially as they move from structural work to interior finishes. This guide provides a realistic, stage-by-stage cost estimate for building a modest 2-bedroom home in Kenya, along with smart...

Public auctions in Kenya offer an often-overlooked opportunity for those seeking to buy property below market value. Whether you're a first-time buyer or a seasoned investor, auctions present a way to access homes, land or commercial spaces at competitive prices provided you understand how the process works and are aware of the risks involved. In this guide, we’ll walk you through how public auctions...

In Kenya’s evolving property market, houses priced below Ksh 5 million represent a sweet spot for affordability, quality, and location. For aspiring homeowners who want more than basic shelter but still need to stick to a reasonable budget, this price range opens the door to a surprisingly diverse array of housing options. Whether you are a first-time buyer, a growing family, or an investor, houses for...

Affordable housing in Kenya continues to be one of the most pressing concerns for middle- and low-income earners. With rising property prices and limited access to financing, many Kenyans assume that homeownership is a distant dream. But what if you could actually find houses priced under Ksh 1 million? It turns out, you can if you know where and how to look. Can You Really Buy a House for Under 1...

In the face of rapid urbanization, growing populations, and limited resources, one housing strategy is proving both practical and empowering: incremental housing. This approach, which allows people to build their homes gradually over time based on their financial ability and evolving needs, offers a realistic and sustainable solution to the global housing crisis particularly for low- and middle-income...

Buying a home is one of the biggest financial commitments many people will ever make. For most aspiring homeowners in Kenya, saving enough money to buy a house outright can be difficult. Fortunately, real estate developers now offer flexible developer payment plans that make it easier for buyers to acquire property without needing the entire amount upfront. If you’re planning to buy a home, apartment,...

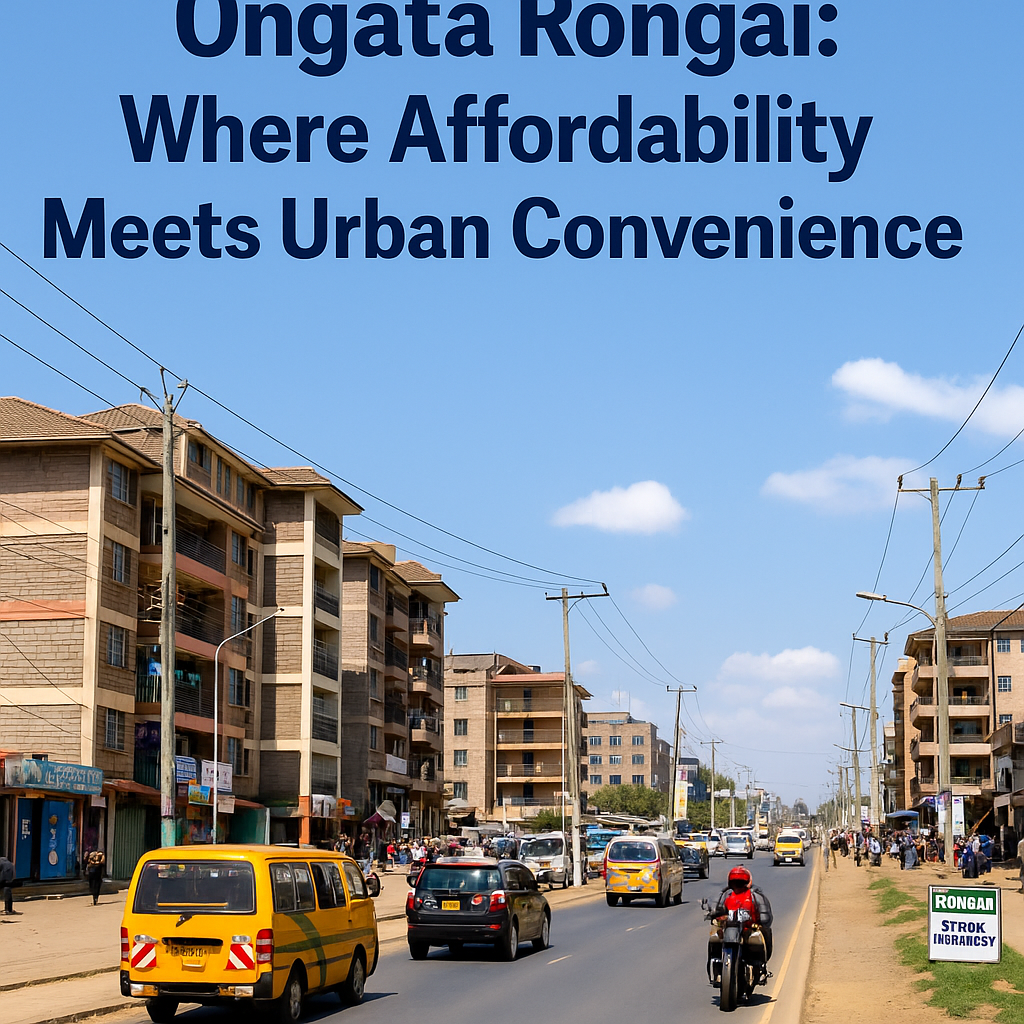

Tucked just beyond the southern edge of Nairobi National Park, Ongata Rongai has steadily transformed from a quiet satellite town into one of the most dynamic residential hubs for students, young professionals, and budget-conscious homebuyers. With its strategic location, expanding infrastructure, and pocket-friendly property market, Rongai offers a compelling case for anyone looking to live affordably...

Buying a fixer-upper isn’t just about rolling up your sleeves and repainting walls it’s about maximizing value. Whether you’re renovating to sell or rent, understanding your return on investment (ROI) is critical. But where do you begin? And how do you know if you’re fixing up a gold mine or a money trap? In this article, we’ll break down the essentials of calculating ROI on fixer-uppers and...

When it comes to real estate, everyone’s looking for that golden investment a property that doesn’t just house memories but multiplies money. Surprisingly, some of the best opportunities lie not in shiny new developments, but in neglected or forgotten homes. Often dismissed as risky or too rundown, these properties can become incredible wealth-builders with the right vision and effort. The...